Embarking on the journey of farm management necessitates a keen understanding of financial intricacies, and at the heart of this lies effective bookkeeping. This guide provides a comprehensive overview of how to manage farm bookkeeping, ensuring accurate financial records and informed decision-making.

From grasping fundamental principles to leveraging advanced technologies, we’ll explore essential aspects such as setting up your system, recording income and expenses, managing assets and liabilities, and navigating tax considerations. This journey will empower you to streamline your farm’s financial operations and foster long-term success.

Understanding Farm Bookkeeping Basics

Accurate farm bookkeeping is the cornerstone of sound financial management, providing crucial insights into a farm’s performance and informing critical business decisions. It goes beyond simply tracking income and expenses; it’s a comprehensive system that captures the financial health of the operation. Mastering the fundamentals is the first step toward improving profitability and achieving long-term sustainability.

Fundamental Principles of Farm Bookkeeping

Farm bookkeeping adheres to the same fundamental accounting principles as any other business, but it is tailored to the specific activities and challenges of agricultural operations. These principles ensure that financial information is reliable, consistent, and comparable.

- Accrual Accounting vs. Cash Accounting: Farms can choose to use either accrual or cash accounting methods. Cash accounting recognizes income when cash is received and expenses when cash is paid. Accrual accounting recognizes income when it is earned and expenses when they are incurred, regardless of when cash changes hands. Accrual accounting provides a more accurate picture of a farm’s financial performance over time, especially for operations with significant inventories and deferred payments.

- The Accounting Equation: The fundamental accounting equation,

Assets = Liabilities + Owner’s Equity

, forms the basis of all bookkeeping systems. Assets represent what the farm owns (e.g., land, equipment, inventory), liabilities represent what the farm owes (e.g., loans, accounts payable), and owner’s equity represents the owner’s stake in the farm.

- Double-Entry Bookkeeping: Every financial transaction affects at least two accounts. For example, when a farm purchases seed, the expense account (e.g., seed expense) increases, and either the cash account decreases or the accounts payable account increases, ensuring that the accounting equation always balances.

- Matching Principle: Expenses should be recognized in the same accounting period as the revenues they help generate. For instance, the cost of fertilizer used to grow a crop should be recognized in the same period as the revenue from selling that crop.

- Consistency: Once a farm chooses an accounting method or a way to account for a particular item, it should use that method consistently from period to period to allow for meaningful comparisons of financial performance over time.

Key Bookkeeping Terms Specific to Agriculture

Understanding these terms is essential for interpreting financial statements and making informed decisions.

- Inventory: Inventory represents the value of unsold products, inputs, and supplies held by the farm. This can include crops in the field, harvested crops in storage, livestock, feed, seed, fertilizer, and other inputs. Accurately tracking inventory is crucial for determining the cost of goods sold and calculating profit margins. For example, a grain farm might have an inventory of stored corn valued at the current market price, adjusted for storage and handling costs.

- Depreciation: Depreciation is the systematic allocation of the cost of a tangible asset (e.g., machinery, buildings) over its useful life. It reflects the decline in the asset’s value due to wear and tear, obsolescence, or the passage of time. Depreciation expense is recorded on the income statement, reducing net income. The depreciation method chosen (e.g., straight-line, declining balance) impacts the expense recorded each year.

For example, a tractor purchased for $100,000 with an estimated useful life of 10 years might be depreciated at $10,000 per year using the straight-line method.

- Cost of Goods Sold (COGS): COGS represents the direct costs associated with producing and selling the farm’s products. This includes the cost of seed, fertilizer, labor, and other inputs used to grow a crop, as well as the cost of feed, veterinary care, and other inputs used to raise livestock. Calculating COGS is crucial for determining gross profit.

COGS = Beginning Inventory + Purchases – Ending Inventory

. For instance, a dairy farm’s COGS would include the cost of feed, veterinary services, and other expenses directly related to milk production.

- Accrued Expenses: Expenses that have been incurred but not yet paid. These are recorded as liabilities on the balance sheet and expenses on the income statement in the period they are incurred. For example, unpaid labor costs or accrued interest on a loan.

- Accounts Receivable: Money owed to the farm by customers for goods or services that have been delivered.

- Accounts Payable: Money owed by the farm to suppliers for goods or services received.

Importance of Accurate Record-Keeping for Farm Profitability and Decision-Making

Accurate and timely record-keeping is not just a regulatory requirement; it’s a vital management tool. It enables informed decision-making, helps improve profitability, and facilitates access to financing.

- Profitability Analysis: Detailed records allow farmers to analyze their profitability by product, enterprise, or operation. This helps identify which activities are most profitable and where costs can be reduced. For example, a farmer can compare the profitability of corn versus soybeans or analyze the cost of production for different fields.

- Budgeting and Planning: Accurate records provide the historical data needed for creating realistic budgets and financial plans. This helps in forecasting future income and expenses, managing cash flow, and making informed investment decisions. A farm can use past yields and input costs to estimate the profitability of planting a new crop.

- Cost Control: Detailed records allow farmers to track and control their costs. They can identify areas where expenses are excessive and implement strategies to reduce costs, such as negotiating better prices for inputs or improving efficiency. Analyzing fuel consumption in machinery operations can help optimize usage and reduce costs.

- Financial Reporting: Accurate records are essential for preparing financial statements, such as the income statement, balance sheet, and cash flow statement. These statements provide a clear picture of the farm’s financial performance and position, which is crucial for securing loans, attracting investors, and complying with tax regulations.

- Tax Compliance: Well-maintained records are necessary for preparing accurate tax returns and complying with tax laws. They help minimize tax liabilities and avoid penalties. Proper documentation supports deductions for expenses, depreciation, and other tax benefits.

- Benchmarking: Farm records allow for benchmarking against industry averages and other similar farms. This helps farmers assess their performance relative to their peers and identify areas for improvement. For example, comparing crop yields or livestock production efficiency to regional averages can reveal opportunities to enhance practices.

Setting Up Your Farm Bookkeeping System

Establishing a robust bookkeeping system is crucial for any farm. It provides the financial clarity needed for informed decision-making, tax compliance, and long-term sustainability. This section Artikels the steps involved in setting up a practical and efficient farm bookkeeping system, focusing on software selection, record organization, and essential financial reporting.

Choosing Farm Bookkeeping Software

Selecting the right bookkeeping software can significantly streamline your farm’s financial management. The ideal software will be user-friendly, meet your specific needs, and integrate with other farm management tools.

- Evaluate Your Farm’s Needs: Consider the size and complexity of your farm operation. A small, direct-market farm will have different needs than a large-scale, diversified operation. Determine the features you require, such as inventory tracking, payroll management, and integration with banking institutions.

- Research Available Software: Explore various software options. Popular choices include QuickBooks Online, Xero, and specialized farm accounting software like AgExpert Analyst. Research their features, pricing, and user reviews. Look for software that offers mobile access for convenience.

- Consider Ease of Use and Support: Choose software with a user-friendly interface and readily available support. Look for tutorials, online help, and responsive customer service. A steep learning curve can be a barrier to adoption.

- Assess Integration Capabilities: Determine if the software integrates with other tools you use, such as point-of-sale systems, farm management software, and banking platforms. Seamless integration saves time and reduces the risk of data entry errors.

- Prioritize Security and Data Backup: Ensure the software offers robust security measures to protect your financial data. Cloud-based software typically provides automatic data backups, which are crucial for data protection.

- Compare Pricing and Features: Compare the costs of different software packages and the features they offer. Consider whether the subscription fees align with your budget and the value provided. Some software offers tiered pricing plans based on features and usage.

Designing a System for Organizing Farm Financial Records

Effective record organization is fundamental to accurate bookkeeping. A well-designed system ensures that all financial transactions are accurately documented, easily accessible, and compliant with tax regulations.

- Establish a Filing System: Create a filing system for both physical and digital records. Physical records, such as receipts and invoices, can be organized in folders or binders. Digital records, such as bank statements and electronic invoices, can be stored in a structured file system on your computer or in the cloud.

- Categorize Transactions: Define clear categories for all farm income and expenses. Examples of income categories include crop sales, livestock sales, and government payments. Expense categories could include feed, fertilizer, labor, and equipment repairs. Consistent categorization is essential for accurate financial reporting.

- Implement a Receipt Management System: Require receipts for all business-related expenses. Receipts should be organized and easily accessible. Consider using a scanning app or software to digitize receipts and store them electronically.

- Reconcile Bank Statements Regularly: Reconcile your bank statements with your bookkeeping records on a monthly basis. This process verifies the accuracy of your records and helps identify any discrepancies or errors.

- Use a Chart of Accounts: Develop a chart of accounts that lists all the financial accounts used in your bookkeeping system. This chart provides a framework for categorizing and tracking all financial transactions. A well-designed chart of accounts facilitates accurate financial reporting.

- Implement a Backup System: Regularly back up all your financial data, whether it’s stored on your computer or in the cloud. This protects your data from loss due to hardware failure, theft, or other unforeseen events.

Essential Financial Reports for Tax Purposes and Farm Management

Generating accurate financial reports is critical for tax compliance and informed farm management decisions. These reports provide insights into your farm’s financial performance and position.

- Income Statement (Profit and Loss Statement): This report summarizes your farm’s revenues and expenses over a specific period, such as a month, quarter, or year. It reveals your farm’s profitability.

- Balance Sheet: The balance sheet provides a snapshot of your farm’s assets, liabilities, and equity at a specific point in time. It helps you assess your farm’s financial position and solvency.

- Cash Flow Statement: This report tracks the movement of cash in and out of your farm over a specific period. It shows where your cash is coming from and how it is being used.

- Schedule F (Profit or Loss from Farming): This is the primary tax form used by farmers to report their income and expenses to the IRS. It’s essential to accurately complete Schedule F to comply with tax regulations.

- Depreciation Schedule: This schedule lists all depreciable assets used in your farm operation and calculates the annual depreciation expense. Depreciation is a non-cash expense that reduces your taxable income.

- Inventory Valuation: Track the value of your farm’s inventory, including crops, livestock, and supplies. Accurate inventory valuation is essential for determining your cost of goods sold and calculating your farm’s profitability.

Recording Income and Expenses

Accurate recording of income and expenses is crucial for understanding your farm’s financial performance. It provides a clear picture of profitability, helps in making informed decisions, and is essential for tax reporting. Meticulous record-keeping allows you to track the flow of money in and out of your farm business, providing valuable insights into its financial health.

Recording Farm Income: Sales of Crops, Livestock, and Other Products

Accurately recording all sources of income is paramount to understanding your farm’s revenue streams. This involves documenting all sales, from the harvest of crops to the sale of livestock and any other products or services provided by your farm.To properly record farm income, consider the following:

- Crop Sales: This includes all income generated from selling harvested crops. Records should include the type of crop, quantity sold (e.g., bushels, tons, pounds), the selling price per unit, the date of the sale, and the customer. For instance, if you sell 100 bushels of corn at $7 per bushel on October 26th to a local grain elevator, you would record $700 in corn sales.

- Livestock Sales: Track the sales of livestock, including cattle, hogs, poultry, and other animals. Records must include the type of animal, number sold, weight (if applicable), selling price per unit, the date of sale, and the buyer. For example, if you sell five feeder calves at $1,500 each on November 15th to a livestock auction, you would record $7,500 in livestock sales.

- Other Product Sales: This covers the sale of any other products or services your farm offers, such as eggs, milk, honey, firewood, or agritourism activities. Records should include the product or service, quantity sold, price per unit, date of sale, and the customer. For example, if you sell 20 dozen eggs at $4 per dozen on a weekly basis to a local restaurant, you would record $80 in egg sales per week.

- Government Payments and Subsidies: These payments, such as those from the Farm Service Agency (FSA) or other government programs, are considered income. Record the date received, the program name, and the amount received. For example, if you receive a conservation payment of $1,000 on June 10th, record this as income.

- Sales Documentation: Always maintain proper documentation, such as invoices, sales receipts, and settlement sheets from grain elevators or livestock auctions. This documentation is essential for supporting your income records and for tax purposes.

Categorizing Farm Expenses

Categorizing farm expenses correctly is vital for analyzing your farm’s costs and profitability. Grouping expenses into logical categories allows for a clear understanding of where your money is being spent and aids in identifying areas for potential cost savings.Here are common farm expense categories:

- Feed Costs: This includes all expenses related to feeding livestock, such as purchased feed, supplements, and minerals. Example: $5,000 spent on hay in July.

- Seed and Fertilizer: Costs associated with purchasing seeds, fertilizers, and soil amendments for crop production. Example: $3,000 spent on corn seed in April.

- Chemicals: Expenses for herbicides, pesticides, and other chemicals used in crop and livestock production. Example: $1,000 spent on herbicides in May.

- Labor: Costs related to hired labor, including wages, salaries, and payroll taxes. Example: $10,000 paid in wages to farmhands throughout the year.

- Fuel and Oil: Expenses for fuel, oil, and lubricants used in farm machinery and vehicles. Example: $2,000 spent on diesel fuel.

- Repairs and Maintenance: Costs for repairing and maintaining farm machinery, buildings, and equipment. Example: $1,500 spent on repairing a tractor.

- Utilities: Expenses for electricity, water, and other utilities used on the farm. Example: $500 spent on the electricity bill.

- Interest: Interest paid on loans related to the farm operation. Example: $2,000 paid in interest on a farm operating loan.

- Rent and Lease: Payments for land, buildings, and equipment that are rented or leased. Example: $3,000 paid in land rent.

- Insurance: Premiums paid for farm insurance, including property, liability, and crop insurance. Example: $1,000 paid for crop insurance.

- Marketing and Transportation: Expenses related to marketing farm products and transporting them to market. Example: $500 spent on transportation costs.

- Depreciation: The allocated cost of farm assets, such as machinery and buildings, over their useful life. This is a non-cash expense.

Tracking Cash and Accrual Accounting Methods

Farms can choose to use either the cash or accrual accounting method. The choice significantly impacts how income and expenses are recognized and reported. Each method has advantages and disadvantages, and the best choice depends on the farm’s specific circumstances.

- Cash Accounting: In cash accounting, income is recorded when cash is received, and expenses are recorded when cash is paid out. It is a straightforward method, often easier to implement, and suitable for smaller farms.

Example: If you sell a crop for $1,000 on December 28th and receive payment on January 5th, you record the income in January under cash accounting.

- Accrual Accounting: In accrual accounting, income is recorded when it is earned, regardless of when cash is received, and expenses are recorded when they are incurred, regardless of when cash is paid. This method provides a more accurate picture of the farm’s financial performance over a specific period.

Example: If you sell a crop for $1,000 on December 28th, even if payment is not received until January 5th, you record the income in December under accrual accounting. If you receive an invoice for $500 for fertilizer in December, you record the expense in December, even if you don’t pay the invoice until January.

- Choosing the Right Method: The IRS generally allows farms to use the cash method if their average annual gross receipts for the three prior tax years are $26 million or less. Larger farms may be required to use the accrual method. Consulting with a tax professional is essential to determine the most suitable accounting method for your farm and ensure compliance with tax regulations.

Managing Assets and Liabilities

Accurately managing farm assets and liabilities is crucial for assessing the financial health of your farm. It provides a clear picture of what the farm owns (assets) and what it owes (liabilities). Proper tracking enables informed decision-making, helps secure financing, and ensures compliance with financial reporting requirements. This section details how to effectively manage these essential components of farm bookkeeping.

Identifying Farm Assets and Tracking Their Value

Farm assets represent everything the farm owns that has economic value. These assets are categorized and tracked to determine the farm’s net worth.The primary categories of farm assets include:

- Current Assets: These assets are expected to be converted to cash or used within one year. Examples include:

- Cash and cash equivalents (checking accounts, savings accounts).

- Accounts receivable (money owed to the farm for products sold).

- Marketable livestock (animals intended for sale within the year).

- Crops held for sale (harvested crops stored for later sale).

- Feed and supplies (ingredients and materials used in farm operations).

- Intermediate Assets: These assets have a useful life of one to ten years. Examples include:

- Breeding livestock (animals used for reproduction).

- Machinery and equipment (tractors, combines, etc.).

- Vehicles (trucks, cars used for farm operations).

- Long-Term Assets: These assets have a useful life of more than ten years. Examples include:

- Land (farmland owned by the farm).

- Buildings (barns, storage sheds, etc.).

- Improvements to land (fences, irrigation systems).

Tracking the value of these assets involves the following methods:

- Cost: This is the original purchase price of the asset, including any associated costs like shipping or installation.

- Market Value: This is the price an asset would fetch if sold in the current market. It’s often used for current assets like crops or livestock.

- Book Value: This is the asset’s cost less accumulated depreciation. Book value is a critical component of financial statements and is used for intermediate and long-term assets.

An example of tracking asset value is a tractor purchased for $100,000. Initially, the value recorded is $100,000. Over time, depreciation reduces its book value. If the tractor has $20,000 of accumulated depreciation, its book value is $80,000. This value is then used in the balance sheet.

Recording Farm Liabilities

Farm liabilities represent the financial obligations of the farm. Accurately recording these is vital for understanding the farm’s debt burden and financial risk. Liabilities are categorized based on their maturity:

- Current Liabilities: Obligations due within one year.

- Accounts payable (money owed to suppliers for inputs).

- Accrued expenses (expenses incurred but not yet paid, such as utilities).

- Current portion of long-term debt (principal payments due within the year).

- Short-term loans (loans with a repayment term of less than one year).

- Long-Term Liabilities: Obligations due in more than one year.

- Farm mortgages (loans secured by farm real estate).

- Long-term loans for equipment or buildings.

Accurate recording of liabilities involves:

- Tracking all loans: Maintaining a detailed record of each loan, including the lender, loan amount, interest rate, repayment schedule, and outstanding balance.

- Monitoring accounts payable: Regularly reviewing invoices and ensuring timely payment to avoid late fees and maintain good relationships with suppliers.

- Reconciling bank statements: Comparing bank statements with the farm’s records to ensure all liabilities are accurately reflected.

For example, a farm takes out a $50,000 loan for a new combine with an annual payment of $10,000. In the current liabilities section, the $10,000 payment is recorded, while the remaining $40,000 is recorded as a long-term liability.

Calculating Depreciation on Farm Equipment and Buildings

Depreciation is the process of allocating the cost of an asset over its useful life. It reflects the decrease in value of an asset due to wear and tear, obsolescence, or other factors. Calculating depreciation is crucial for accurately reflecting the value of farm assets on financial statements and for tax purposes.Common depreciation methods include:

- Straight-Line Depreciation: This method allocates an equal amount of depreciation expense each year. The formula is:

Depreciation Expense = (Cost – Salvage Value) / Useful Life

Where:

- Cost is the original cost of the asset.

- Salvage value is the estimated value of the asset at the end of its useful life.

- Useful life is the estimated period the asset will be used.

For example, a tractor costing $100,000 with a salvage value of $10,000 and a useful life of 10 years would have an annual depreciation expense of ($100,000 – $10,000) / 10 = $9,000.

- Declining Balance Depreciation: This method depreciates the asset at a higher rate in the early years of its life and a lower rate later on. It is based on a percentage of the asset’s book value. The formula is:

Depreciation Expense = Book Value

Depreciation Rate

Where:

- Book Value is the asset’s cost less accumulated depreciation.

- Depreciation Rate is a predetermined percentage (e.g., double-declining balance uses twice the straight-line rate).

- Units of Production Depreciation: This method depreciates the asset based on its actual use. The formula is:

Depreciation Expense = ((Cost – Salvage Value) / Total Units of Production)

Units Produced During the Year

Where:

- Total Units of Production is the estimated total output of the asset over its useful life.

- Units Produced During the Year is the actual output for the year.

For example, a combine costing $200,000 with a salvage value of $20,000 is estimated to harvest 10,000 acres. If the combine harvests 1,000 acres in a year, the depreciation expense would be (($200,000 – $20,000) / 10,000) – 1,000 = $18,000.

It is important to consistently apply the chosen depreciation method and to maintain accurate records of each asset’s cost, useful life, and accumulated depreciation. The IRS provides guidelines on acceptable depreciation methods and useful lives for various farm assets. Using these guidelines ensures that depreciation calculations are compliant with tax regulations.

Payroll and Labor Management

Managing payroll and labor effectively is crucial for any farm operation. It ensures compliance with legal requirements, fosters a positive work environment, and allows for accurate cost tracking. Properly handling payroll not only satisfies legal obligations but also builds trust with employees, leading to increased productivity and reduced turnover. This section will guide you through the essential aspects of farm payroll and labor management.

Calculating Wages and Withholding Taxes

Accurately calculating wages and withholding the correct taxes is a fundamental aspect of farm payroll. This involves determining gross pay, calculating deductions, and issuing pay stubs.To calculate gross pay, you must consider the following:

- Hourly Employees: Multiply the hourly rate by the total hours worked. Remember to include overtime pay at a rate of one and a half times the regular hourly rate for hours exceeding 40 in a workweek, as mandated by the Fair Labor Standards Act (FLSA).

- Salaried Employees: Determine the annual salary and divide it by the number of pay periods in a year.

- Piece-Rate Employees: Calculate wages based on the number of units produced or tasks completed.

Once the gross pay is calculated, you must withhold the following taxes:

- Federal Income Tax: The amount withheld depends on the employee’s W-4 form (Employee’s Withholding Certificate) and the applicable tax brackets.

- Social Security and Medicare Taxes (FICA): Employers and employees each contribute a percentage of the employee’s gross wages. The current Social Security tax rate is 6.2% of wages up to a certain threshold, and the Medicare tax rate is 1.45% of all wages.

- State and Local Income Taxes: The amount withheld depends on the state and local tax laws and the employee’s W-4 equivalent form.

You should also account for:

- Deductions: Deductions such as health insurance premiums, retirement contributions, and other voluntary deductions, are taken out of gross pay.

- Net Pay: This is the amount the employee receives after all deductions and taxes are withheld.

Issuing accurate pay stubs is a legal requirement and provides transparency. Pay stubs must include:

- Employee’s name and address

- Employer’s name and address

- Pay period dates

- Gross wages

- Total deductions

- Net pay

- Tax withholdings

A simplified formula for calculating net pay is:

Net Pay = Gross Pay – (Federal Income Tax + Social Security Tax + Medicare Tax + State/Local Income Tax + Other Deductions)

For example, consider a farm employee who works 45 hours in a week and earns $15 per hour. The employee’s gross pay would be calculated as follows: 40 hours

- $15/hour + 5 hours

- ($15/hour

- 1.5) = $712.50. The employer would then calculate and withhold the appropriate taxes and any other deductions to arrive at the employee’s net pay.

Complying with Labor Laws and Regulations

Farm operations must adhere to a complex set of labor laws and regulations to ensure fair treatment of workers and avoid legal penalties. These laws cover various aspects of employment, including minimum wage, overtime pay, working conditions, and employee safety.Key areas of compliance include:

- Minimum Wage: Farms must pay employees at least the federal or state minimum wage, whichever is higher. Some states have higher minimum wage rates than the federal standard.

- Overtime Pay: Non-exempt employees are entitled to overtime pay at a rate of one and a half times their regular hourly rate for hours worked over 40 in a workweek. Certain exemptions may apply to agricultural workers.

- Wage Payment Frequency: State laws dictate how often employees must be paid. Pay periods are usually weekly, bi-weekly, or monthly.

- Working Conditions: Farms must provide a safe and healthy work environment, including adequate sanitation facilities, access to drinking water, and protection from hazardous substances. The Occupational Safety and Health Administration (OSHA) sets standards for workplace safety.

- Child Labor Laws: Farms must comply with federal and state laws regarding the employment of minors, including restrictions on the types of work they can perform and the hours they can work.

- Recordkeeping: Accurate and complete records of wages, hours worked, and deductions must be maintained. These records are essential for demonstrating compliance with labor laws.

- Immigration Laws: Farms that employ foreign workers must comply with federal immigration laws, including the H-2A visa program, which allows U.S. employers to bring in temporary foreign workers to fill agricultural jobs.

Non-compliance with labor laws can result in significant penalties, including fines, back wages, and legal action. Staying informed about the latest labor laws and regulations is critical. Consulting with a labor law attorney or a human resources professional can help farms ensure compliance.

Tracking and Allocating Labor Costs

Tracking labor costs and allocating them to different farm activities is essential for accurate financial analysis and informed decision-making. This process involves monitoring labor expenses and assigning them to specific tasks, crops, or projects.To effectively track and allocate labor costs:

- Establish a System: Implement a system for tracking labor hours, such as time sheets, time tracking software, or a payroll system.

- Categorize Labor: Classify labor into different categories, such as direct labor (e.g., harvesting, planting), indirect labor (e.g., supervision, maintenance), and administrative labor.

- Allocate Costs: Assign labor costs to specific farm activities or cost centers. This can be done by tracking the time employees spend on each activity or by using a predetermined allocation method, such as allocating labor costs based on the acreage of each crop.

- Calculate Labor Cost per Unit: Determine the labor cost per unit of output (e.g., per bushel of corn, per pound of produce). This helps assess the efficiency of labor and identify areas for improvement.

- Use a Spreadsheet or Software: Utilize spreadsheets or farm accounting software to track and analyze labor costs. These tools can help generate reports and provide insights into labor efficiency.

An example of allocating labor costs involves a fruit farm. The farm has three main activities: planting, harvesting, and packing. They track the time each employee spends on each activity using a time sheet. The total labor costs for the month are then divided among these three activities based on the hours worked. The labor cost per unit (e.g., per pound of fruit harvested) is calculated by dividing the total labor cost for harvesting by the total pounds of fruit harvested.

This information can be used to assess the profitability of each activity and make informed decisions about resource allocation.

Financial Statements and Analysis

Understanding and analyzing financial statements is crucial for effective farm management. These statements provide a snapshot of a farm’s financial health, allowing for informed decision-making regarding operations, investments, and long-term sustainability. By examining the income statement, balance sheet, and relevant financial ratios, farmers can assess profitability, solvency, and efficiency. This analysis enables them to identify areas for improvement, secure financing, and ultimately achieve their financial goals.

Creating a Basic Income Statement for a Farm

The income statement, also known as the profit and loss (P&L) statement, summarizes a farm’s financial performance over a specific period, typically a year. It reflects the revenues generated and the expenses incurred during that period, ultimately determining the net profit or loss. The following illustrates the key components of a farm income statement:Here is a simplified example of a farm income statement:

| Item | Amount ($) |

|---|---|

| Revenue: | |

| Sales of Crops | 150,000 |

| Sales of Livestock | 80,000 |

| Government Payments | 10,000 |

| Other Revenue | 5,000 |

| Total Revenue | 245,000 |

| Expenses: | |

| Seed and Fertilizer | 30,000 |

| Feed Costs | 25,000 |

| Labor | 40,000 |

| Fuel and Oil | 10,000 |

| Depreciation | 15,000 |

| Interest Expense | 8,000 |

| Other Expenses | 7,000 |

| Total Expenses | 135,000 |

| Net Profit (or Loss) | 110,000 |

- Revenue: This represents the income generated from the farm’s operations. It includes sales of crops, livestock, and any other revenue sources, such as government payments or custom work.

- Expenses: These are the costs incurred in producing the farm’s output. Common expenses include seed, fertilizer, feed, labor, fuel, depreciation, and interest.

- Net Profit (or Loss): Calculated by subtracting total expenses from total revenue. A positive number indicates a profit, while a negative number indicates a loss.

Designing a Balance Sheet for a Farm

The balance sheet provides a snapshot of a farm’s financial position at a specific point in time. It illustrates what the farm owns (assets), what it owes (liabilities), and the owner’s stake in the farm (equity). The balance sheet adheres to the fundamental accounting equation:

Assets = Liabilities + Equity

Here is a simplified example of a farm balance sheet:

| Item | Amount ($) |

|---|---|

| Assets: | |

| Current Assets: | |

| Cash | 20,000 |

| Accounts Receivable | 10,000 |

| Inventory (Crops & Livestock) | 30,000 |

| Total Current Assets | 60,000 |

| Non-Current Assets: | |

| Land | 500,000 |

| Buildings | 100,000 |

| Equipment | 80,000 |

| Total Non-Current Assets | 680,000 |

| Total Assets | 740,000 |

| Liabilities: | |

| Current Liabilities: | |

| Accounts Payable | 15,000 |

| Current Portion of Long-Term Debt | 5,000 |

| Total Current Liabilities | 20,000 |

| Non-Current Liabilities: | |

| Long-Term Debt | 200,000 |

| Total Non-Current Liabilities | 200,000 |

| Total Liabilities | 220,000 |

| Equity: | |

| Owner’s Equity | 520,000 |

| Total Liabilities & Equity | 740,000 |

- Assets: These are the resources owned by the farm, categorized as either current (easily convertible to cash within a year) or non-current (long-term assets like land and equipment).

- Liabilities: These represent the farm’s obligations to others, classified as current (due within a year) or non-current (due in more than a year).

- Equity: This represents the owner’s stake in the farm, calculated as the difference between assets and liabilities.

Detailing the Use of Key Financial Ratios for Assessing Farm Performance and Profitability

Financial ratios provide valuable insights into a farm’s financial performance and help in assessing areas such as profitability, liquidity, solvency, and efficiency. These ratios can be compared to industry benchmarks, past performance, or future goals to identify strengths and weaknesses.

- Profitability Ratios: These ratios measure the farm’s ability to generate profits.

- Net Profit Margin:

Net Profit / Total Revenue

. This ratio indicates the percentage of revenue that translates into profit. A higher ratio is generally more desirable. For instance, a net profit margin of 10% means that for every dollar of revenue, the farm earns 10 cents in profit.

- Return on Assets (ROA):

Net Profit / Total Assets

. ROA measures how effectively a farm uses its assets to generate profit. A higher ROA indicates better asset utilization.

- Return on Equity (ROE):

Net Profit / Owner’s Equity

. This ratio indicates the return generated on the owner’s investment in the farm. A higher ROE suggests better profitability for the owner.

- Liquidity Ratios: These ratios assess the farm’s ability to meet its short-term obligations.

- Current Ratio:

Current Assets / Current Liabilities

. This ratio indicates the farm’s ability to pay its current liabilities with its current assets. A ratio of 2:1 is often considered healthy, but it can vary depending on the industry. For example, a current ratio of 2.5 means the farm has $2.50 in current assets for every $1 of current liabilities.

- Working Capital:

Current Assets – Current Liabilities

. This is the difference between current assets and current liabilities. It indicates the amount of liquid assets available to cover short-term obligations. A positive working capital position is generally preferred.

- Solvency Ratios: These ratios measure the farm’s ability to meet its long-term obligations and its overall financial stability.

- Debt-to-Asset Ratio:

Total Liabilities / Total Assets

. This ratio indicates the proportion of a farm’s assets financed by debt. A lower ratio is generally preferable, indicating less financial risk. For example, a debt-to-asset ratio of 0.4 means that 40% of the farm’s assets are financed by debt.

- Debt-to-Equity Ratio:

Total Liabilities / Owner’s Equity

. This ratio shows the relationship between debt and equity financing. A lower ratio indicates a more conservative financial structure.

- Efficiency Ratios: These ratios measure how efficiently a farm utilizes its assets.

- Asset Turnover Ratio:

Total Revenue / Total Assets

. This ratio measures how effectively a farm generates revenue from its assets. A higher ratio indicates better asset utilization.

Tax Considerations for Farmers

Understanding and managing farm taxes is crucial for financial success and compliance. Farmers face unique tax obligations and opportunities, requiring careful attention to detail and a proactive approach to tax planning. This section Artikels the essential tax considerations for farmers, offering insights into requirements, deductions, and audit preparation.

Basic Tax Requirements for Farmers

Farmers are subject to various tax obligations, similar to other businesses, but with specific nuances related to agricultural activities. Understanding these requirements is fundamental for compliance and effective financial management.Farmers are typically subject to the following tax obligations:* Income Tax: Farmers must pay income tax on their farm profits, which are calculated as gross income minus deductible expenses.

This is reported on Schedule F (Form 1040), Profit or Loss From Farming. The tax rate depends on the farmer’s overall income and tax bracket.

Self-Employment Tax

Farmers are generally considered self-employed and are responsible for paying self-employment tax, which covers both Social Security and Medicare taxes. This tax is calculated on the net earnings from self-employment (Schedule SE, Form 1040). For 2023, the self-employment tax rate is 15.3% (12.4% for Social Security and 2.9% for Medicare) on the first $160,200 of earnings.

The calculation for self-employment tax is

Net Earnings from Self-Employment x 0.9235 x 0.153.

Property Tax

Farmers are typically required to pay property taxes on land, buildings, and other real estate used for farming operations. Property tax rates and assessment methods vary by state and local jurisdiction.

Employment Taxes

If a farm employs workers, the farmer is responsible for withholding and paying federal income tax, Social Security tax, Medicare tax, and federal unemployment tax (FUTA) from employee wages. State unemployment taxes (SUTA) may also be required.

Common Farm Tax Deductions and Credits

Farmers have access to a variety of tax deductions and credits that can help reduce their tax liability. Taking advantage of these opportunities requires careful record-keeping and an understanding of the relevant tax laws.Here are some common farm tax deductions and credits:* Operating Expenses: These include ordinary and necessary expenses incurred in the operation of the farm, such as:

- Feed and seed purchased for the farm.

- Fertilizers, lime, and other chemicals used for crop production.

- Labor hired, including wages, payroll taxes, and benefits.

- Repairs and maintenance of farm equipment and buildings.

- Rent paid for farmland or buildings.

- Interest paid on farm loans.

- Fuel and oil used for farm operations.

- Insurance premiums for farm property and liability.

Depreciation

Farmers can deduct the cost of farm assets, such as machinery, equipment, and buildings, over their useful lives. This is known as depreciation.

Conservation Expenses

Farmers can deduct expenses related to soil and water conservation, such as the cost of terracing, contouring, and drainage.

Business Use of Home

If a farmer uses a portion of their home exclusively and regularly for business purposes, they may be able to deduct a portion of their home-related expenses, such as mortgage interest, rent, utilities, and insurance.

Qualified Business Income (QBI) Deduction

Farmers may be eligible for a deduction of up to 20% of their qualified business income, subject to certain limitations.

Credits

Farmers may also be eligible for various tax credits, such as:

- Fuel tax credits for off-highway business use.

- The Work Opportunity Tax Credit for hiring certain targeted groups of employees.

- The Credit for Increasing Research Activities.

An example of how deductions can significantly impact a farm’s tax liability: Consider a farmer with a gross income of $200,000. After deducting $100,000 in operating expenses, $20,000 in depreciation, and $5,000 in conservation expenses, the taxable income is reduced to $75,000. This lower taxable income results in a significantly lower tax liability compared to a farmer with a higher taxable income.

How to Prepare for a Farm Tax Audit

Preparing for a farm tax audit involves maintaining accurate records, understanding tax laws, and being organized. Being prepared can help minimize the stress and potential negative outcomes of an audit.Here’s how to prepare for a farm tax audit:* Maintain Accurate Records: Keep detailed records of all income and expenses, including receipts, invoices, bank statements, and other supporting documentation.

Organize Records

Organize records in a systematic manner, such as by category or date, making it easy to locate specific information.

Understand Tax Laws

Be familiar with the tax laws and regulations that apply to farming operations.

Consult with a Tax Professional

Work with a qualified tax professional who specializes in farm taxation to ensure compliance and receive expert advice.

Be Responsive

If contacted by the IRS for an audit, respond promptly and provide all requested information in a timely manner.

Cooperate with the Auditor

Cooperate with the auditor and answer all questions honestly and completely.

Review Returns

Before filing, review tax returns carefully to ensure accuracy and completeness.

Keep Supporting Documents

Retain all supporting documents for at least three years from the date the return was filed, or two years from the date the tax was paid, whichever is later. It’s often recommended to keep records for longer periods, especially if the farm owns assets that are depreciated over a longer period.

Example

A farmer buys a combine in 2020, depreciating it over seven years. Records related to the combine should be retained until at least 2027.

Using Technology for Farm Bookkeeping

In today’s fast-paced agricultural landscape, embracing technology is no longer optional but essential for efficient farm management. Utilizing technology for bookkeeping streamlines financial processes, improves accuracy, and provides valuable insights for informed decision-making. This section explores how technology can revolutionize farm bookkeeping, focusing on the benefits of cloud-based software, comparing different software options, and demonstrating integration with other farm management tools.

Benefits of Cloud-Based Bookkeeping Software for Farms

Cloud-based bookkeeping software offers numerous advantages over traditional methods and even desktop software. These benefits contribute to increased efficiency, better financial control, and improved overall farm management.

- Accessibility and Convenience: Cloud-based software allows farmers to access their financial data from anywhere with an internet connection. This means you can monitor your farm’s finances from the field, your home, or even while traveling.

- Real-time Data and Updates: Data is updated in real-time, providing an up-to-the-minute view of your farm’s financial performance. This immediate access to information allows for quicker responses to market changes or unexpected expenses.

- Collaboration and Data Sharing: Cloud-based systems facilitate easy collaboration with accountants, bookkeepers, and other advisors. Multiple users can access and work on the same data simultaneously, improving communication and reducing errors.

- Automated Data Entry and Reporting: Many cloud-based solutions offer features like automated bank feeds and expense tracking, which significantly reduce manual data entry. They also generate financial reports automatically, saving time and effort.

- Data Security and Backup: Cloud providers typically offer robust data security measures and automatic backups, protecting your financial information from loss due to hardware failures, theft, or natural disasters.

- Scalability and Cost-Effectiveness: Cloud-based software is often subscription-based, making it more affordable than purchasing and maintaining traditional software. You can easily scale your subscription up or down based on your farm’s needs.

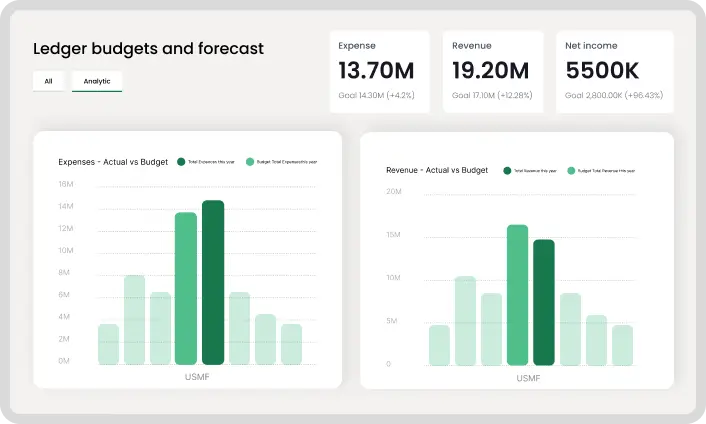

Comparison of Bookkeeping Software Options

Choosing the right bookkeeping software is crucial for efficient farm management. Several options are available, each with its strengths and weaknesses. The following table compares some popular choices, highlighting key features, pricing, and user reviews.

| Software | Features | Pricing (Approximate) | User Reviews (Based on general online reviews) |

|---|---|---|---|

| QuickBooks Online |

|

|

Generally positive, with users praising its ease of use and robust features. Some users note that the more advanced plans can be complex. |

| Xero |

|

|

Highly rated for its user-friendly interface and strong integration capabilities. Some users find the reporting features less comprehensive than QuickBooks. |

| AgriWebb |

|

|

Well-regarded for its focus on livestock management and farm-specific features. User reviews highlight its user-friendliness and comprehensive approach to farm operations. |

| FarmBooks |

|

|

Reviews are generally positive, with users appreciating the software’s focus on the specific needs of farms and ease of use. |

Integrating Farm Bookkeeping Software with Other Farm Management Tools

Integrating bookkeeping software with other farm management tools creates a cohesive and efficient system, streamlining data flow and improving decision-making. This integration minimizes manual data entry and provides a more comprehensive view of farm operations.

- Integration with Farm Management Software: Software like AgriWebb and other specialized farm management platforms can be integrated with bookkeeping software. This allows for the automatic transfer of data related to crop yields, livestock production, and other operational metrics directly into your financial records. For example, if you use a farm management system to track crop harvests, the system can automatically send data about the sales revenue to your bookkeeping software, eliminating the need for manual entry.

- Integration with Point of Sale (POS) Systems: If you sell directly to consumers at farmers’ markets or through a farm stand, integrating your POS system with your bookkeeping software automates the tracking of sales and revenue. This integration can provide real-time sales data, helping you monitor your cash flow and identify trends.

- Integration with Inventory Management Systems: For farms with significant inventory, integrating your bookkeeping software with an inventory management system allows for accurate tracking of the cost of goods sold (COGS). When you sell a product, the system automatically updates your inventory levels and records the associated cost in your bookkeeping software.

- Integration with Banking Systems: Connecting your bookkeeping software with your bank accounts allows for automatic transaction importing and bank reconciliation. This eliminates manual data entry and ensures your financial records are always up-to-date.

- Integration with Payroll Systems: Integrating your bookkeeping software with payroll software automates the recording of payroll expenses, taxes, and deductions. This integration streamlines the payroll process and ensures accurate financial reporting.

Best Practices for Farm Bookkeeping

Maintaining accurate and up-to-date farm records is crucial for making informed financial decisions, securing loans, and ensuring compliance with tax regulations. Implementing best practices helps farmers streamline their bookkeeping processes, minimize errors, and gain a clear understanding of their farm’s financial performance. This section Artikels key strategies to achieve these goals.

Maintaining Accurate and Up-to-Date Farm Records

Keeping meticulous records is fundamental to effective farm bookkeeping. This involves consistently tracking all financial transactions, both income and expenses, to build a reliable financial picture. The following practices contribute to this objective.

- Regular Data Entry: Enter financial transactions promptly, ideally daily or weekly. This prevents information from being forgotten and ensures the accuracy of records. Delayed entry can lead to errors and make it difficult to track the flow of money.

- Detailed Documentation: Maintain supporting documentation for all transactions, including invoices, receipts, bank statements, and loan documents. This documentation serves as proof of transactions and is essential for audits or tax purposes. Keep these documents organized and easily accessible.

- Categorization of Transactions: Categorize all income and expenses using a consistent chart of accounts. This facilitates analysis of financial performance and helps identify areas for improvement. Use categories that are specific to farm operations, such as feed costs, seed expenses, or equipment maintenance.

- Reconciling Accounts Regularly: Reconcile bank statements, credit card statements, and other financial accounts monthly. This process verifies the accuracy of recorded transactions and helps identify any discrepancies or errors.

- Backing Up Data: Regularly back up all financial data, whether it’s stored electronically or in paper form. This protects against data loss due to computer failure, natural disasters, or other unforeseen events. Consider using cloud-based backup solutions or storing copies of paper records in a secure location.

- Using Accounting Software: Utilize farm accounting software or a spreadsheet program to automate bookkeeping tasks and improve accuracy. These tools offer features such as automated transaction entry, reporting, and analysis.

- Seeking Professional Advice: Consult with a qualified accountant or tax advisor who specializes in agriculture. They can provide guidance on bookkeeping best practices, tax planning, and financial management specific to farming operations.

Avoiding Common Bookkeeping Mistakes

Even with the best intentions, errors can occur in farm bookkeeping. Recognizing and avoiding common mistakes can save time, money, and potential headaches.

- Mixing Personal and Business Finances: Keep personal and business finances completely separate. This simplifies record-keeping, protects personal assets, and facilitates accurate financial analysis. Use separate bank accounts, credit cards, and accounting systems for personal and farm-related transactions.

- Incorrect Categorization of Expenses: Ensure that expenses are categorized correctly according to the chart of accounts. Misclassifying expenses can distort financial reports and lead to inaccurate decision-making. Regularly review the chart of accounts and seek clarification if needed.

- Failing to Record All Transactions: Ensure that all income and expenses are recorded, no matter how small. Omitting transactions can result in incomplete financial records and an inaccurate assessment of the farm’s financial performance.

- Neglecting Reconciliation: Regularly reconcile bank statements and other financial accounts. This process helps identify errors, omissions, and discrepancies in a timely manner. Failure to reconcile can lead to undetected errors and inaccurate financial reporting.

- Poor Record Keeping: Maintain organized and easily accessible records. Poorly organized records can make it difficult to find information when needed, leading to wasted time and potential errors.

- Not Staying Updated with Tax Laws: Keep abreast of changes in tax laws and regulations that affect farming operations. Failure to comply with tax requirements can result in penalties and fines. Consult with a tax advisor to stay informed.

- Overlooking Depreciation: Accurately calculate and record depreciation expenses for farm assets, such as machinery, equipment, and buildings. Depreciation is a significant expense that can impact taxable income and financial reporting.

Reconciling Bank Statements and Identifying Discrepancies

Bank reconciliation is a crucial process that ensures the accuracy of farm financial records. It involves comparing the farm’s internal records with the bank’s records to identify any discrepancies. Here’s how to reconcile bank statements and identify potential issues.

- Gather Necessary Documents: Collect the farm’s bank statement for the reconciliation period and a record of all transactions recorded in the farm’s bookkeeping system, such as a general ledger or accounting software.

- Compare Transactions: Compare each transaction on the bank statement with the corresponding entry in the farm’s records. Mark off each transaction that matches.

- Identify Outstanding Items: Identify any transactions recorded in the farm’s records that do not appear on the bank statement (outstanding checks or deposits). These transactions are likely to clear in the next statement period.

- Identify Discrepancies: Investigate any transactions that do not match. This may include:

- Errors in Recording: Review the amounts, dates, and descriptions of transactions for accuracy.

- Missing Transactions: Ensure that all transactions on the bank statement are recorded in the farm’s records.

- Bank Errors: Contact the bank to investigate any errors in the bank statement, such as incorrect amounts or unauthorized transactions.

- Prepare the Reconciliation: Prepare a bank reconciliation statement that summarizes the reconciliation process. The statement typically includes the ending balance from the bank statement, any outstanding items, and any adjustments needed to reconcile the farm’s records with the bank’s records. The final adjusted balance should be the same.

- Example of Bank Reconciliation:

Imagine a farm’s bank statement shows a balance of $10,- The farm’s records show a balance of $9,

- The farm has $1,000 in outstanding checks and a $500 deposit in transit. The bank reconciliation would look like this:

Item Amount Bank Statement Balance $10,000 Add: Deposits in Transit $500 Subtract: Outstanding Checks ($1,000) Adjusted Bank Balance $9,500 - Correct Errors: Correct any errors identified during the reconciliation process by making the necessary adjustments in the farm’s records. This may involve correcting the amount of a transaction, adding a missing transaction, or correcting the categorization of an expense.

- Review and Approve: Review the completed bank reconciliation to ensure accuracy. The reconciliation should be approved by a responsible individual, such as the farm owner or bookkeeper.

Budgeting and Forecasting

Creating a farm budget and developing accurate forecasts are essential for financial planning and ensuring the long-term sustainability of your farm. These processes allow you to anticipate potential financial challenges, make informed decisions about resource allocation, and track your progress towards achieving your financial goals. Effective budgeting and forecasting enable proactive management, minimizing risks and maximizing profitability.

Creating a Farm Budget

A farm budget is a comprehensive financial plan that Artikels projected revenues, expenses, and profitability for a specific period, typically a year. Creating a well-structured budget is a crucial step in farm financial management.

- Revenue Projections: Revenue projections involve estimating the income your farm will generate from the sale of crops, livestock, or other farm products. This process necessitates considering several factors.

- Crop Yields: Estimate the expected yield per acre or per animal based on historical data, soil conditions, weather patterns, and management practices. For example, if your farm has averaged 150 bushels of corn per acre over the past five years, and current conditions are favorable, you might project a yield of 160 bushels per acre.

- Market Prices: Research current and projected market prices for your products. Utilize resources such as the USDA National Agricultural Statistics Service (NASS) reports, futures market data, and local market information to make informed price assumptions. For instance, if the current market price for corn is $6.00 per bushel, factor in potential price fluctuations based on market trends.

- Sales Volume: Determine the total quantity of each product you expect to sell. This is calculated by multiplying the projected yield by the number of acres or animals, then adjusting for any anticipated losses or storage considerations.

- Diversification: If you have diversified income streams (e.g., direct sales, agritourism), incorporate those revenue projections based on historical performance and anticipated customer demand.

- Expense Estimations: Expense estimations involve identifying and quantifying all anticipated costs associated with farm operations.

- Variable Costs: These costs vary with the level of production. Examples include seed, fertilizer, pesticides, fuel, and hired labor. Estimate these costs based on the planned acreage, crop requirements, and current market prices. For example, if the cost of fertilizer is $50 per acre and you are planting 100 acres, your fertilizer expense would be $5,000.

- Fixed Costs: These costs remain relatively constant regardless of production levels. Examples include land rent, depreciation on equipment, insurance, and property taxes. Calculate these costs based on existing contracts, asset values, and insurance premiums.

- Overhead Costs: These costs are related to the general operation of the farm, such as office supplies, utilities, and accounting fees. Allocate these costs based on historical spending and projected needs.

- Contingency Planning: Include a contingency fund (e.g., 5-10% of total expenses) to cover unexpected costs or unforeseen events such as adverse weather or equipment breakdowns.

- Budget Development Steps: Follow a systematic approach to create your farm budget.

- Gather Data: Collect historical financial records, production data, and market information.

- Project Revenue: Estimate income from all sources, considering prices and sales volumes.

- Estimate Expenses: Identify and quantify all variable, fixed, and overhead costs.

- Calculate Profitability: Subtract total expenses from total revenue to determine net profit or loss.

- Analyze and Revise: Review the budget for accuracy and make adjustments as needed based on changing market conditions or operational plans.

Methods for Monitoring and Controlling Farm Expenses

Effective expense management is vital for maximizing farm profitability. Monitoring and controlling expenses require a proactive and disciplined approach.

- Regular Expense Tracking: Implement a system to track all farm expenses in real-time. This could involve using accounting software, spreadsheets, or manual record-keeping.

- Variance Analysis: Compare actual expenses to budgeted amounts regularly (e.g., monthly or quarterly). Identify significant variances and investigate the causes.

- Example: If the actual fuel expense for a month is 20% higher than the budgeted amount, investigate the reason. Was there increased field work, higher fuel prices, or inefficient equipment use?

- Cost Control Strategies: Implement strategies to reduce expenses without compromising productivity or quality.

- Negotiate Prices: Negotiate with suppliers for better prices on inputs like seeds, fertilizers, and chemicals.

- Improve Efficiency: Optimize farm operations to reduce fuel consumption, labor costs, and waste. Implement precision agriculture techniques to minimize input use.

- Manage Inventory: Implement inventory management practices to minimize waste and storage costs.

- Explore Cost-Sharing Programs: Investigate opportunities for cost-sharing programs offered by government agencies or industry organizations.

- Performance Benchmarking: Compare your farm’s expense performance to industry benchmarks or similar farms. This helps identify areas where you can improve cost efficiency. Utilize resources like the USDA Economic Research Service (ERS) or local agricultural extension services for benchmarking data.

Designing a System for Forecasting Farm Cash Flow

Cash flow forecasting predicts the movement of cash into and out of your farm over a specific period. Accurate cash flow forecasting is essential for ensuring that your farm has sufficient funds to meet its financial obligations.

- Cash Inflows: Estimate all sources of cash inflows.

- Sales Revenue: Project income from crop or livestock sales, considering expected sales volumes and prices.

- Government Payments: Include any anticipated government payments, such as subsidies or disaster assistance.

- Loans and Financing: Factor in proceeds from loans or other financing arrangements.

- Other Income: Include income from any other sources, such as custom work or rental income.

- Cash Outflows: Estimate all cash outflows.

- Operating Expenses: Include all expenses paid in cash, such as seed, fertilizer, fuel, and labor.

- Loan Payments: Include principal and interest payments on loans.

- Capital Expenditures: Factor in planned investments in equipment, land, or other assets.

- Other Expenses: Include any other cash payments, such as taxes or insurance premiums.

- Cash Flow Statement: Create a cash flow statement to track projected cash inflows and outflows over time.

- Beginning Cash Balance: Start with the current cash balance at the beginning of the forecast period.

- Add Cash Inflows: Sum all projected cash inflows for the period.

- Subtract Cash Outflows: Subtract all projected cash outflows for the period.

- Ending Cash Balance: The ending cash balance is the beginning cash balance plus net cash flow (inflows minus outflows).

- Forecasting Frequency: Prepare cash flow forecasts on a regular basis.

- Short-Term Forecasts: Prepare weekly or monthly forecasts to manage immediate cash needs.

- Long-Term Forecasts: Prepare quarterly or annual forecasts to plan for larger financial obligations and investments.

- Monitoring and Adjusting: Regularly compare actual cash flows to forecasted amounts. Make adjustments to the forecast as needed based on changing market conditions, production outcomes, or operational decisions.

- Example: If a crop is harvested earlier than anticipated, adjust the cash flow forecast to reflect the earlier sales revenue. If expenses are higher than expected, revise the forecast to account for the increased costs.

- Contingency Planning: Develop contingency plans to address potential cash flow shortfalls.

- Line of Credit: Establish a line of credit to provide access to short-term financing.

- Expense Management: Prioritize essential expenses and delay non-essential spending.

- Inventory Management: Optimize inventory levels to reduce storage costs and improve cash flow.

Resources and Tools

Managing farm bookkeeping efficiently requires access to reliable resources and tools. These resources can range from educational websites and publications to specialized software and professional services. Having these readily available can significantly streamline the bookkeeping process, ensuring accuracy and compliance.

Websites and Publications

Accessing a variety of online resources and publications is vital for staying informed about farm bookkeeping best practices, regulations, and industry trends. These resources offer valuable insights and guidance to farmers.

- USDA Farm Service Agency (FSA): The USDA FSA website provides a wealth of information on farm loans, programs, and financial resources. They often publish guides and templates related to financial management.

- Agricultural Extension Services: State-level agricultural extension services, often affiliated with land-grant universities, offer educational materials, workshops, and one-on-one consultations on farm management, including bookkeeping. These services are frequently tailored to local agricultural practices.

- Farm Credit System: The Farm Credit System provides financial services to farmers and ranchers. Their websites often include articles, webinars, and downloadable resources related to farm finance and bookkeeping.

- Agri-Business Associations: National and regional agricultural associations, such as the American Farm Bureau Federation, often publish newsletters, magazines, and online content covering various aspects of farm management, including financial planning and bookkeeping.

- Government Websites: Websites like the IRS (Internal Revenue Service) provide information on tax regulations and requirements specific to farming operations.

Free Templates

Utilizing free templates can simplify the process of recording financial transactions and tracking key metrics. These templates provide a structured framework for organizing financial data.

- Spreadsheet Templates (Microsoft Excel, Google Sheets): Free spreadsheet templates are readily available for various farm bookkeeping tasks. These can include templates for:

- Income and Expense Tracking: Allows farmers to record all income and expenses, categorizing them for easy analysis.

- Cash Flow Projections: Helps in forecasting future cash inflows and outflows.

- Inventory Tracking: Enables monitoring of farm inventory levels.

- Profit and Loss Statements: Provides a framework for generating basic profit and loss statements.

- Downloadable Forms from Government Agencies: The IRS and other government agencies often provide downloadable forms and worksheets that can be used for tax reporting and financial record-keeping.

Professionals Specializing in Farm Bookkeeping

Engaging the services of qualified professionals can provide specialized expertise and support in managing farm finances. These professionals can offer tailored advice and services to meet the unique needs of agricultural businesses.

- Certified Public Accountants (CPAs): CPAs with experience in agricultural accounting can provide comprehensive financial services, including tax preparation, financial statement analysis, and consulting. They can help farmers understand complex tax regulations and optimize their financial strategies.

- Bookkeepers: Bookkeepers can handle the day-to-day recording of financial transactions, ensuring accurate and timely record-keeping. They often specialize in specific industries, including agriculture.

- Farm Management Consultants: Farm management consultants offer a broader range of services, including financial planning, budgeting, and operational analysis. They can provide insights into improving farm profitability and efficiency.

- Tax Preparers: Tax preparers can assist with the preparation and filing of tax returns. They are knowledgeable about tax laws and can help farmers minimize their tax liabilities.

Concluding Remarks

In conclusion, mastering the art of farm bookkeeping is paramount for sustainable agricultural practices. By implementing the strategies Artikeld, you can confidently manage your farm’s finances, make informed decisions, and ultimately, achieve greater profitability and operational efficiency. This knowledge equips you with the tools needed to thrive in the competitive agricultural landscape.